Date:2024-10-30 Click:

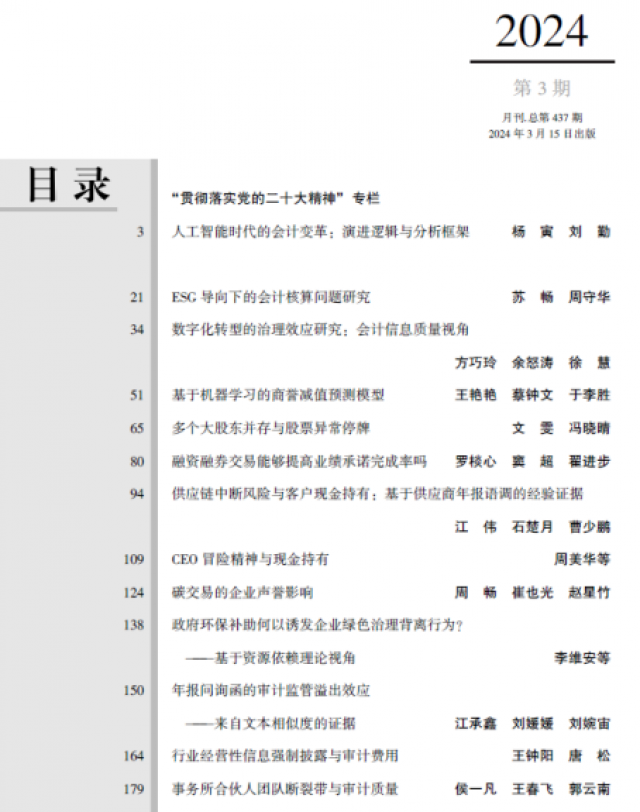

Recently, Associate Professor Zhou Meihua from the School of Accounting collaborated with Master's student Li Ruining from Xiamen University, Associate Professor Cao Jian from Harbin Institute of Technology(Shenzhen), and Professor Lin Bin from Sun Yat sen University to complete a paper titled《CEO Adventure Spirit and CashHolding》, which was published in the authoritative domestic A-journal《AccountingResearch》in the third issue of 2024. Among them, Li Ruining is a 2017 undergraduate student from the School of Accounting at our university, and was later recommended to pursue a Master's degree in Accounting at the School of Management, XiamenUniversity.

The psychological factors of executives can have a significant impact on a company's financial policies. The paper studied the impact of CEO risk-taking spirit on a company's cash holdings and found that the higher the CEO's risk-taking spirit, the lower the company's cash holdings. In addition, financing constraints can reduce the negative correlation between the two, while financing demand enhances the negative correlation between the two. Mechanism testing found that CEO risk-taking spirit affects cash holding levels through company investments. Further research has found that CEO risk-taking spirit can enhance a company's cash value and is significantly positively correlated with accounting and market performance. The research in this paper helps to understand the impact of executive psychological factors on financial decision-making, and has important implications for cash holding decisions of listedcompanies.